ending work in process inventory calculation

Subtract the estimated cost of goods sold step 2 from the cost of goods available for sale step 1 to arrive at the ending inventory. The calculation of cost of goods sold starts with A.

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

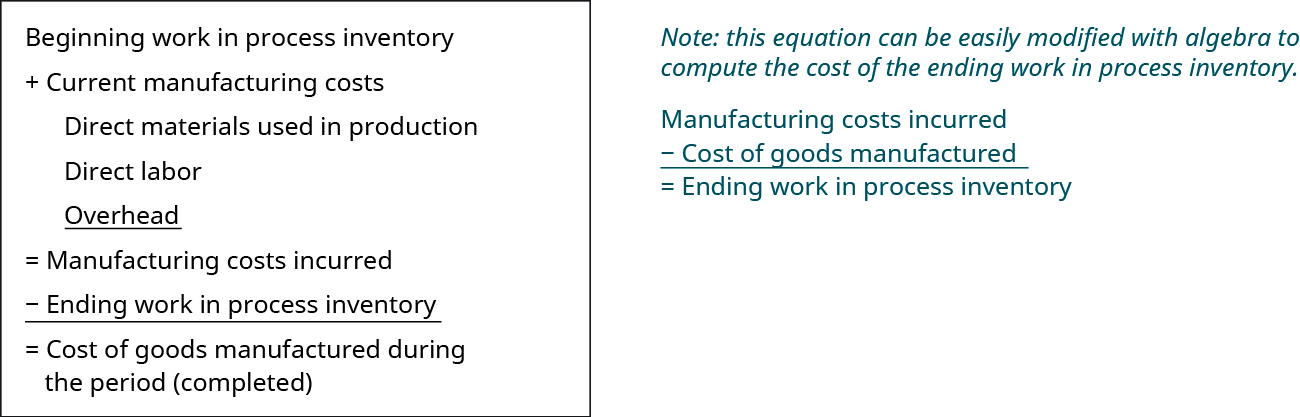

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory.

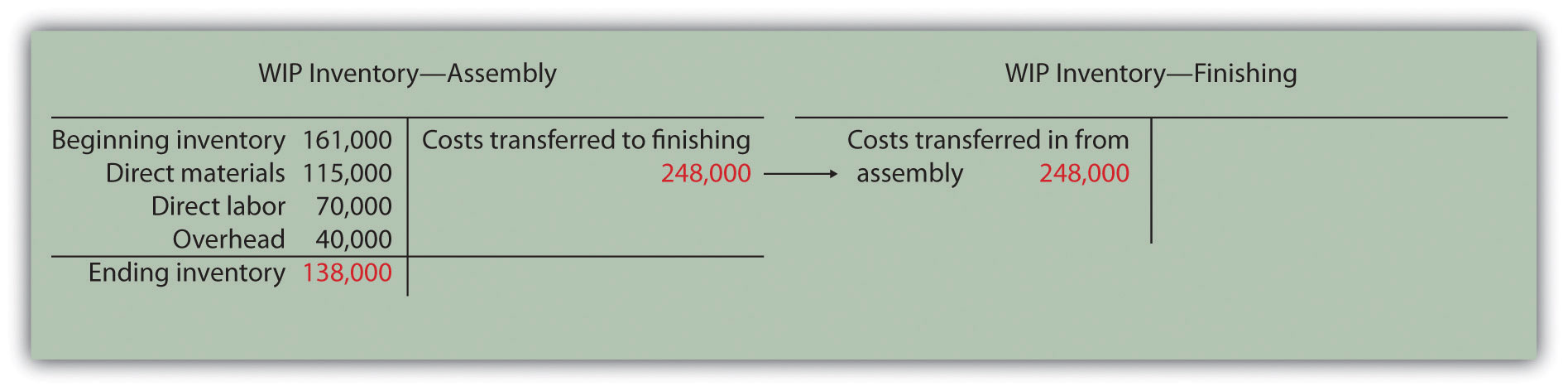

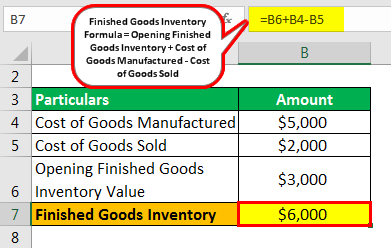

. To calculate your in-process inventory the following WIP inventory formula is followed. Beginning Finished Goods Inventory. Example Calculation of Cost of Goods Manufactured COGM This can be more clearly seen in a T-account.

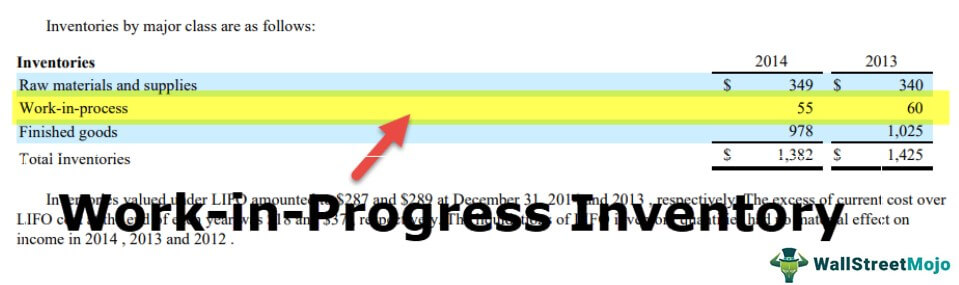

Ending Work in - Process Inventory B. The ending work in progress inventory is important for a couple of reasons. To calculate WIP inventory you need the beginning work in process inventory and to calculate that you need the ending work in process inventory.

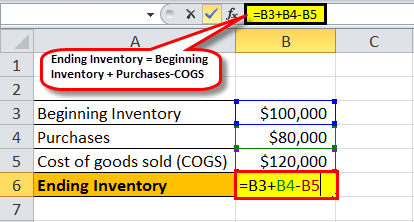

Most businesses that are not run by experienced operations management experts will have too much work in process. 100000 150000 150000 100000. Ending Inventory beginning inventory net purchases - prices of products sold Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net purchases and subtract the prices of products sold from their sum and you get the value for the ending inventory as shown below.

Over the year the company incurs 300000 in production costs and produces finished goods at a cost of 250000. A physical count or a cycle counting program is needed for an accurate ending inventory valuation. The calculation of ending work in process is.

Additional Business Financial. The formula for ending work in process is relatively simple. WIP e WIP b C m - C c.

Formulas to Calculate Work in Process. In this equation WIP e ending work in process. Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period.

The ending work in process inventory is then valued at. Calculating Your Work-In-Process Inventory. And C c cost of goods completed.

C m cost of manufacturing. The formula is as follows. WIP b beginning work in process.

Work in progress accounting involves tracking the amount of WIP in inventory at the end of an accounting period and assigning a cost to it for inventory valuation. Ending Work in Process WIP Inventory COGM. In this equation WIPe ending work in process.

Heres how it looks. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. Take a look at how it looks in the formula.

And Cc cost of goods completed. Ending WIP Inventory Beginning WIP Inventory Production Costs Finished Goods Cost. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

WIP Inventory amount Beginning Work in Process Inventory Manufacturing Costs Cost of Manufactured Goods Work in Process VS Work in Progress. Ending inventory using work in process Beginning WIP Manufacturing costs Cost of goods manufactured 8000 240000 - 238000 10000 Ending inventory using work in process 10000. Because it is an asset not calculating the WIP and including it on the firms balance sheet may cause the total.

The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. Cm cost of manufacturing. The last quarters ending work in process.

Ending Finished Goods Inventory OD. Work in process inventory calculations should refer to the past quarter month or year. 3 Methods to Calculate the Ending Inventory 1 FIFO First in First Out Method 2 LIFO Last in First Out Method 3 Weighted Average Cost Method.

Multiply 1 expected gross profit by sales during the period to arrive at the estimated cost of goods sold. Furthermore what is the cost of the ending work in process inventory. Work in process inventory 60000.

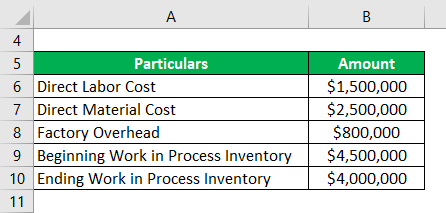

From there you would calculate ending WIP inventory amount. For example lets say that a company that manufactures furniture incurs the following costs. Work In-process Inventory Example.

Assume Company A manufactures perfume. How to Calculate Ending Work In Process Inventory The work in process formula is. 10000 300000 - 250000 60000.

It is important to note that the methods of calculating ending inventory can only be used for estimating the inventory. What is the difference between work in process and work in progress inventory. WIPb beginning work in process.

This ending inventory figure is listed as a current asset on a balance sheet. Beginning WIP Manufacturing Costs - Cost of Goods Manufactured Ending Work in Process. Once these steps have been completed the expenses can be divided by.

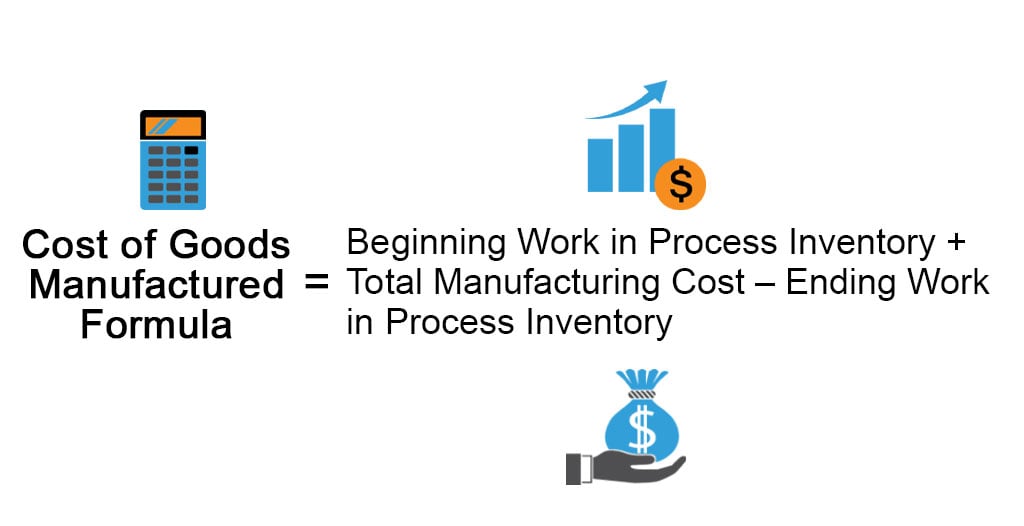

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Ignoring work in process calculations entirely.

In this latter case inventory essentially shifts directly from the raw materials inventory to the finished goods inventory with no separate work in process accounting at all. How do you calculate ending inventory units. In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods.

Beginning Work in - Process Inventory C. Thus your ending WIP inventory comes out to be 100000 for the year.

Ending Inventory Formula Step By Step Calculation Examples

Inventory Formula Inventory Calculator Excel Template

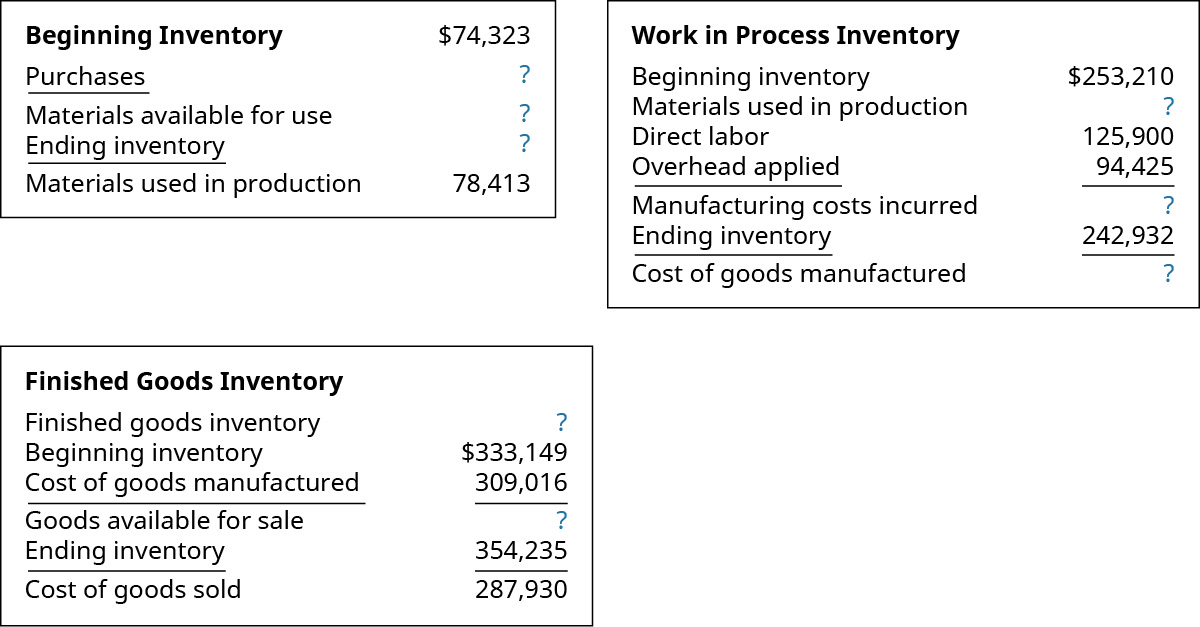

Finished Goods Inventory How To Calculate Finished Goods Inventory

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

What Is Work In Process Wip Inventory How To Calculate It Ware2go

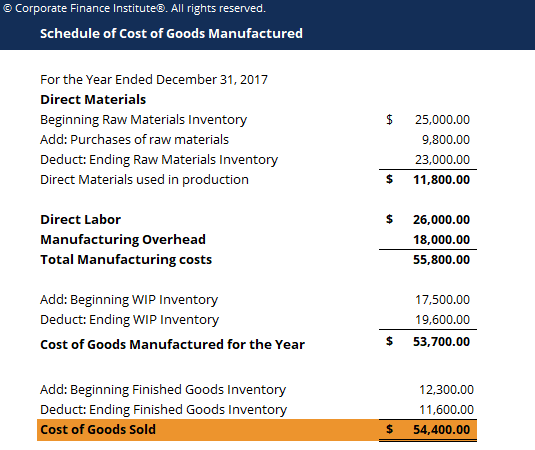

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Dsm Chapter 18 With Explanations Flashcards Quizlet

Manufacturing Account Format Double Entry Bookkeeping

Ending Work In Process Double Entry Bookkeeping

Wip Inventory Definition Examples Of Work In Progress Inventory

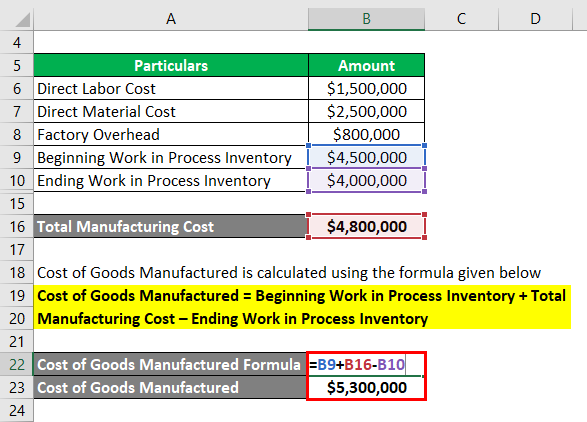

Cost Of Goods Manufactured Formula Examples With Excel Template

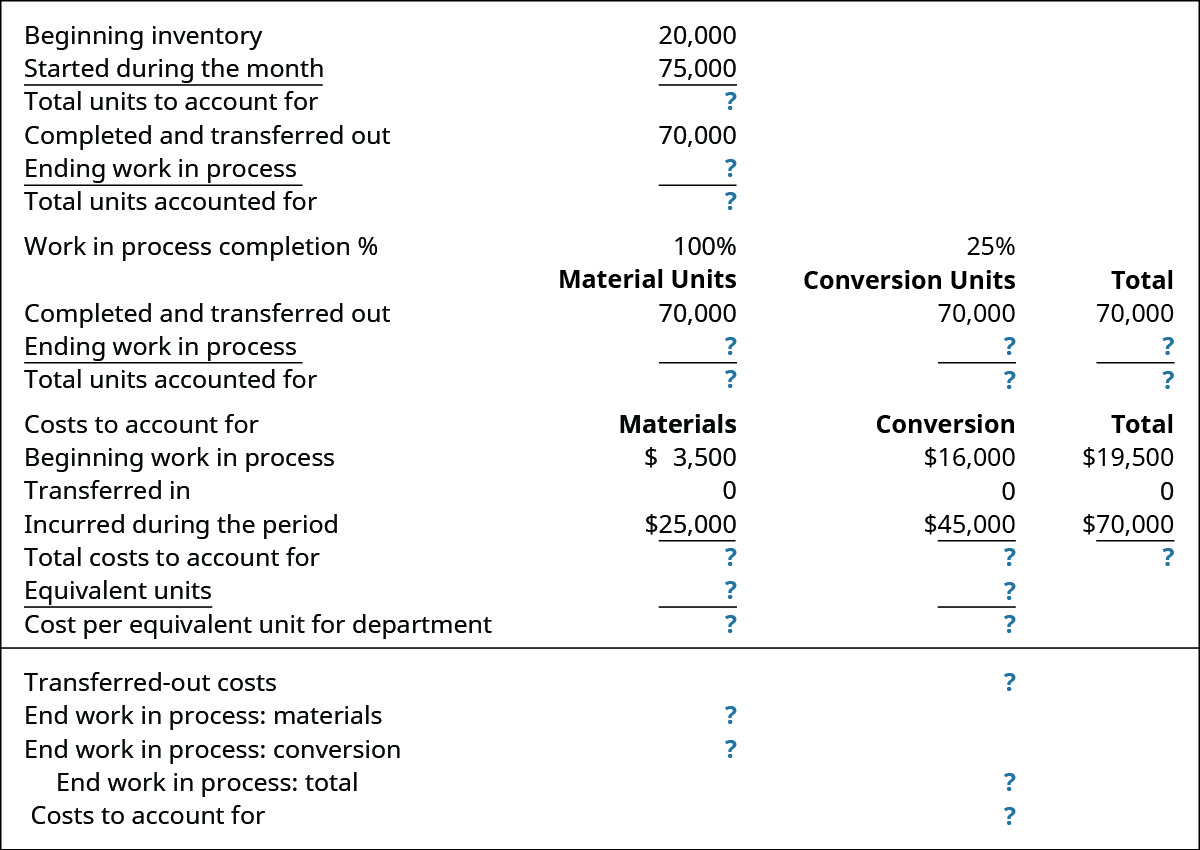

Explain And Compute Equivalent Units And Total Cost Of Production In A Subsequent Processing Stage Principles Of Accounting Volume 2 Managerial Accounting

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Work In Process Wip Inventory Youtube

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Cost Of Goods Manufactured Formula Examples With Excel Template